In the convergence of artificial intelligence (AI) and the Internet of Things (IoT)—what we broadly call AIoT—we are witnessing one of the most significant inflection points in the industrial era. Yet the true breakthrough will not come merely from more advanced models or more connected sensors, but rather from deep industry-embedded business models, measurable ROI, and the architecture of a distributed, autonomous intelligence system in the physical world.

Drawing upon three seminal reports released in 2025—

- McKinsey & Company’s Technology Trends Outlook 2025

- Bessemer Venture Partners’ The State of AI 2025

- Massachusetts Institute of Technology (MIT) NANDA initiative’s The GenAI Divide: State of AI in Business 2025

This article set forth an actionable perspective on the current state of AIoT, industry pain-points, and the roadmap for what comes next.

Table of contents

Current State of AIoT

AI working as the Operating System of the Physical World

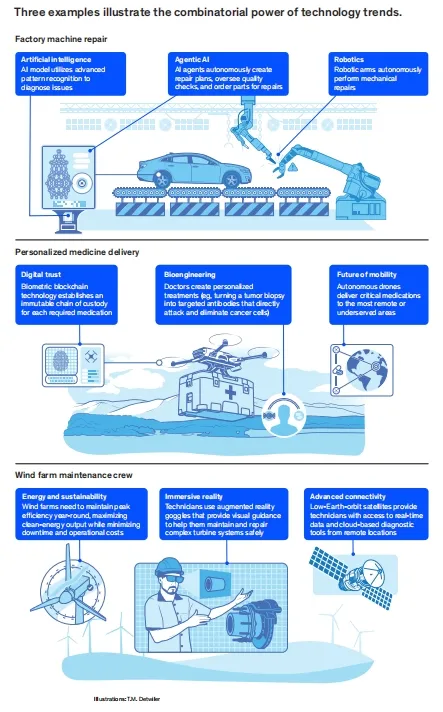

McKinsey’s 2025 technology trends emphasize that AI is no longer simply a tool for data analytics—it is becoming the “operating system” underlying industries, infrastructure, and assets. In sectors such as manufacturing, energy, transportation and smart infrastructure, AI is increasingly embedded into connected devices, edge computing nodes, robotics and automation. The physical-digital boundary is blurring.

In the realm of IoT, this means the traditional model of “sensor → cloud → dashboard” is giving way to “sensor + compute + decision-capability at edge → autonomous action”. For example, connected physical assets with embedded AI can make decisions, coordinate with other assets, and adapt in real time—ushering in what we might call “intelligent things” rather than “mere smart devices”.

Scenario-Focus & ROI as the Commercialization Imperative

Both Bessemer’s and MIT’s reports underscore a central point: the path from technology to business value demands specific, deep-embedded use-cases rather than broad, generic AI hype. Bessemer characterizes successful AI companies as those which anchor into high-pain, high-ROI vertical workflows. On the other hand, MIT’s research draws attention to the alarming reality that 95% of enterprise generative-AI pilots generate no measurable business return.

Translated into AIoT terms: the success factor moves from “let’s connect everything and apply a big model” to “let’s identify a critical physical‐asset workflow, embed AIoT tightly, measure ROI, scale.” The shift is from technology deployment to business deliverable.

Platform + Ecosystem Outweighs Solo Innovation

As AIoT systems become more complex—with multiple device types, connectivity (edge, 5G, satellite), data-flows, AI models, operations and integrations—the reports highlight that companies cannot succeed by going it alone. Ecosystem-oriented platform strategies are rising. McKinsey points to the importance of distributed intelligence, and global intelligent networks. Bessemer also emphasises that AI-native companies are focusing not only on algorithms, but via standard protocols, open interfaces and multi-party collaboration, resources are integrated, capabilities are shared and efficiency is enhanced.

The key to achieving breakthrough progress in the AIoT field lies in adhering to a platform mindset and actively building an ecosystem. So only through in-depth collaboration and resource integration across fields and entities, forming a close industrial alliance, can we promote the in-depth development of industrial collaborative innovation and achieve large-scale application.

Industry Pain-Points & Diverging Viewpoints

While the three reports show strong alignment on big trends, they also illuminate key strategic tension points within AIoT-adopting enterprises. These tensions are around investment logic, resource allocation and implementation strategy.

| Strategic Tension | Viewpoint A | Viewpoint B | Underlying Conflict |

| Self-build vs. external procurement | Build in-house (complete control, proprietary) | Partner/collaborate (higher success rates, less reinventing) | Capabilities vs. speed & cost. MIT found in many cases self-built AI systems succeed (~33 %) far less than externally partnered ones (~67 %). |

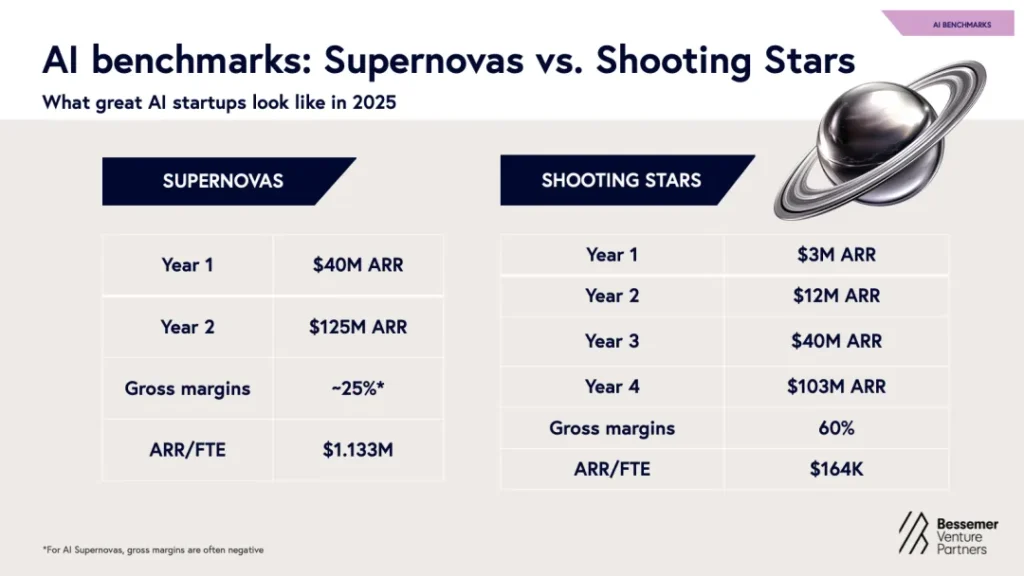

| Explosive growth vs. sustainable resilience | Go big fast (market share, blitz scale) | Grow steadily in verticals (customer stickiness, margin) | Short-term opportunity vs. long-term value. Bessemer distinguishes “supernova” AI firms vs “shooting stars” scaling more gradually. |

| Front-end (customer experience) vs. back-end (operations) focus | Invest heavily in UX, marketing, interface | Invest in operations, supply chain, hidden value chain | Surface visibility vs real business value. MIT and Bessemer caution many projects focus on front-end but earn ROI from back-end improvement. |

These are not just academic debates—but also reflect operational decisions in AIoT programs: Do we build our own intelligent edge platform or partner? Do we capture market hype now, or build for durability? Do we leverage AI in the shiny customer-facing applications, or in the, frankly less glamorous, asset maintenance and operations workflows?

The bias in the industry has often been toward the flashy front-end and heavy self-build, but the reports suggest that will yield many failures if back-end and ecosystem fundamentals are neglected.

Future Pathway: From Connected to Autonomous, From Devices to Agentic Systems

Having understood where AIoT is now and the friction points, the roadmap ahead becomes clearer. The ultimate breakthrough not only lies in moving from connectivity and embedded intelligence to autonomy, but also collaboration, and distributed intelligence networks.

Key enablers of that future:

- Autonomous decision-making: Each physical node in an AIoT network should have the capability to sense, decide and act, often without central intervention. This is a step beyond scripted automation. McKinsey terms this next wave “agentic AI”.

- Cross-device and cross-workflow collaboration: Intelligent devices shouldn’t act in isolation but should coordinate with other devices, humans and systems to create new service loops.

- Memory, context and adaptation: Devices and models must learn over time, retain context, adapt to evolving conditions and integrate with business processes (not just be “dumb” connected things). Bessemer highlights this as the next moat.

- Distributed intelligence architecture: Instead of all intelligence centralised in the cloud, intelligence increasingly moves to the edge, to device clusters, to federated or mesh architectures. For global scale and resilience, AIoT must support decentralised, autonomous networks.

- Ecosystem & trust infrastructure: Platforms, open standards, data governance, security, regulatory compliance—all become foundational. As MIT’s report emphasises, absence of trust, workflow integration, and domain-fit cause most AI investments to fail.

In short, the future AIoT is not about “smart devices” but about intelligent agents embedded in physical systems that collaborate, learn, and evolve. orming what you might call a “distributed physical intelligence economy”.

Implications & Where Industry Opportunity Lies

From the above, some implications for business and industrial players become clear:

- Winners will not be those with the shiniest technology, but those with tangible business value + ecosystem leadership. It’s about measurable ROI and partner network strength.

- High-value domains and high-ROI workflows are the focus. For example:

- Smart manufacturing → operations/maintenance efficiency

- Energy/utility management → asset health, grid edge intelligence

- Smart transportation/traffic systems → device lifecycle, logistics optimisation

- Back-office operations and hidden value chains matter more than just front-end visibility. AIoT initiatives need to go deeper into operational workflows, not just user interfaces.

- Strategic investment decisions matter: For companies considering whether to build in-house, partner, scale fast or scale sustainably—the choice must align with resources, business model, industry maturity.

- Ecosystem thinking is required: For IoT especially, it’s rarely one company doing all—from device hardware, connectivity, edge compute, AI software, analytics, maintenance services—collaboration wins.

- The next decade is about enabling autonomy and coordination: The emphasis shifts from “connect devices” to “connect intelligence, connect action”.

Final Thoughts

In summary, the fusion of AI and IoT is not a futuristic novelty—it is happening now and is rapidly becoming the operational backbone of industries. But the real breakthrough is not purely technological—it is commercial and architectural.

The three reports show us:

- The direction is clear (AI + IoT convergence)

- The challenges are real (ROI gaps, execution difficulty, ecosystem complexity)

- The pathway is defined (industry use-cases, autonomy, collaboration, platform ecosystems)

If your company, your team or your strategy is in the business of AIoT, then the imperative is not just to experiment—but to embed, measure, scale. Build for business value. Partner for scale. Architect for autonomy.

Because ultimately, the next wave of winners in AIoT will be companies that transform connected devices into intelligent collaborators, embed AI into core physical processes, and drive new economic systems—not just connect sensors and run models.

Now is the moment to act.